FHSA Savings Account Step up your first-home savings.

Make for your down payment the way you want, with 3.00% tax-free* on a FHSA Savings Account, or for an even better return that's guaranteed, an FHSA GIC.

The FHSA Savings Account is not currently available in Quebec.

Get started

A better (and faster) way to save for your first home

The EQ Bank FHSA Savings Account goes further than most other FHSAs offered by the other guys. It isn’t just for parking your savings with some tax advantages, it’s to make on your savings too. So take your hard-earned money a lot further and a lot faster, with tax-free high interest on every dollar you put towards your goal of owning a home.

FHSA GICs

If owning a home is more of a long-term goal, an FHSA GIC is a great way to take your savings even further. Explore our full range of rates and term options on our GIC page.

Get your FHSA info and get started

What is an FHSA?

An FHSA is a tax-advantaged registered plan that lets you save for your first home. Your contributions reduce your taxable income (up to a lifetime maximum of $40,000), and you can withdraw the money—tax-free—for any qualifying home purchase1.

Who is eligible for an FHSA?

You can open an FHSA if you:

- Are a Canadian resident

- Are aged 18– 71

- Are a first-time homebuyer2

Why choose an EQ Bank FHSA?

Our FHSA Savings Account doesn’t just help you save for your first home, it helps you get there faster, with 3.00% tax-free interest* on all your savings.

Take advantage of today’s contribution room

Whether you’re saving to become a homeowner soon or several years from now, a great next step is to build contribution room today. It all starts with opening our FHSA.

Sign up to get started by opening a Personal AccountWhat are the contribution guidelines?

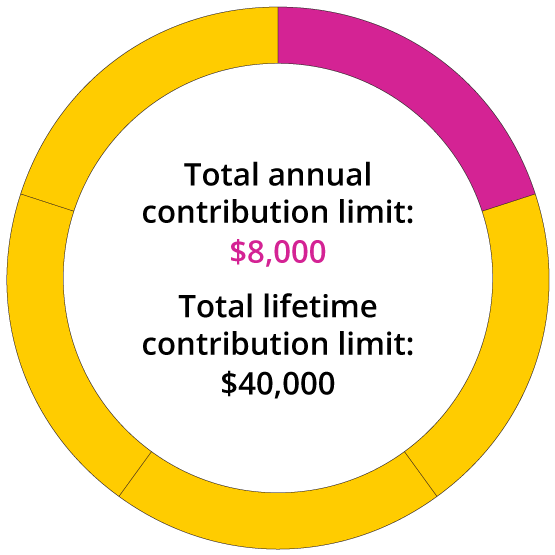

You can contribute up to $8,000 annually—with a lifetime contribution limit of $40,000. Any unused contribution room can carry forward to the following year up to a maximum of $8,000.

For example, if you contribute $5,000 to your FHSA in 2023, you’ll be allowed to contribute $11,000 in 2024.

Any contributions over the $8,000 annual limit (except for any unused portions from the previous year) will be penalized 1% on the highest excess amount in the month, for each month that the excess remains in your account.

How does an FHSA compare to a TFSA or RRSP?

| Benefits | FHSA | TFSA | RRSP |

|---|---|---|---|

| Contributions are tax-deductible | |||

| Withdrawals are tax-free | |||

| Withdrawals don’t need to be paid back |

How does an FHSA compare to a TFSA or RRSP?

| Benefits | FHSA | TFSA | RRSP |

|---|---|---|---|

| Contributions are tax-deductible | |||

| Withdrawals are tax-free | |||

| Withdrawals don’t need to be paid back |

Common questions answered

Visit our FAQ for more details about FHSA.

Why wait? Give your home ownership goal a boost today.

Join EQ Bank and start saving for your first home in minutes.

Get started by opening a Savings Plus Account