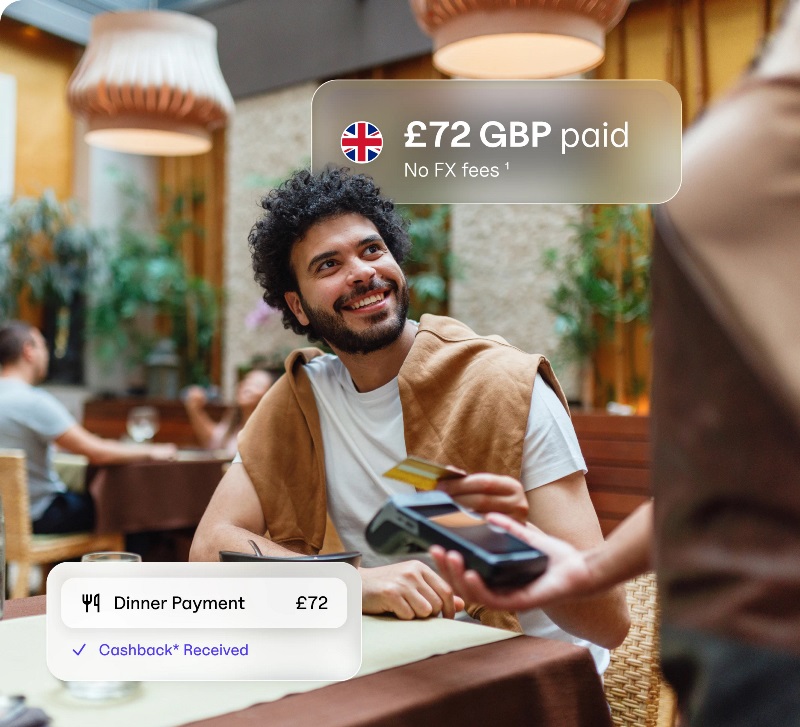

Spend abroad without worrying about extra fees.

With the EQ Bank Card(Footnote 3), we pass on Mastercard's exchange rate directly to you, without the 2.5% fee that most cards charge.

-

Charge you to access your own money? Not us.

Wherever you are in the world, get the cash you need without ever seeing ATM fees from us, even if others may charge you. We’ll even reimburse the fees charged by ATM providers here at home in Canada.

-

This card works here, there, and everywhere

The EQ Bank Card works just like any other card you use to spend what you want, where you want, and when you want. Almost anywhere in the world where Mastercard(Footnote ®) is accepted—that’s more than 210 countries, by the way—with no foreign transaction fees(Footnote 1). Plus, you can add it to your mobile wallet for contactless spending (and earning) from anywhere.

The card that makes without the take

High interest until you spend. Cash back(Footnote *) when you do. And zero hidden fees when you use your card.

Get your free cardHow EQ Bank Card works

-

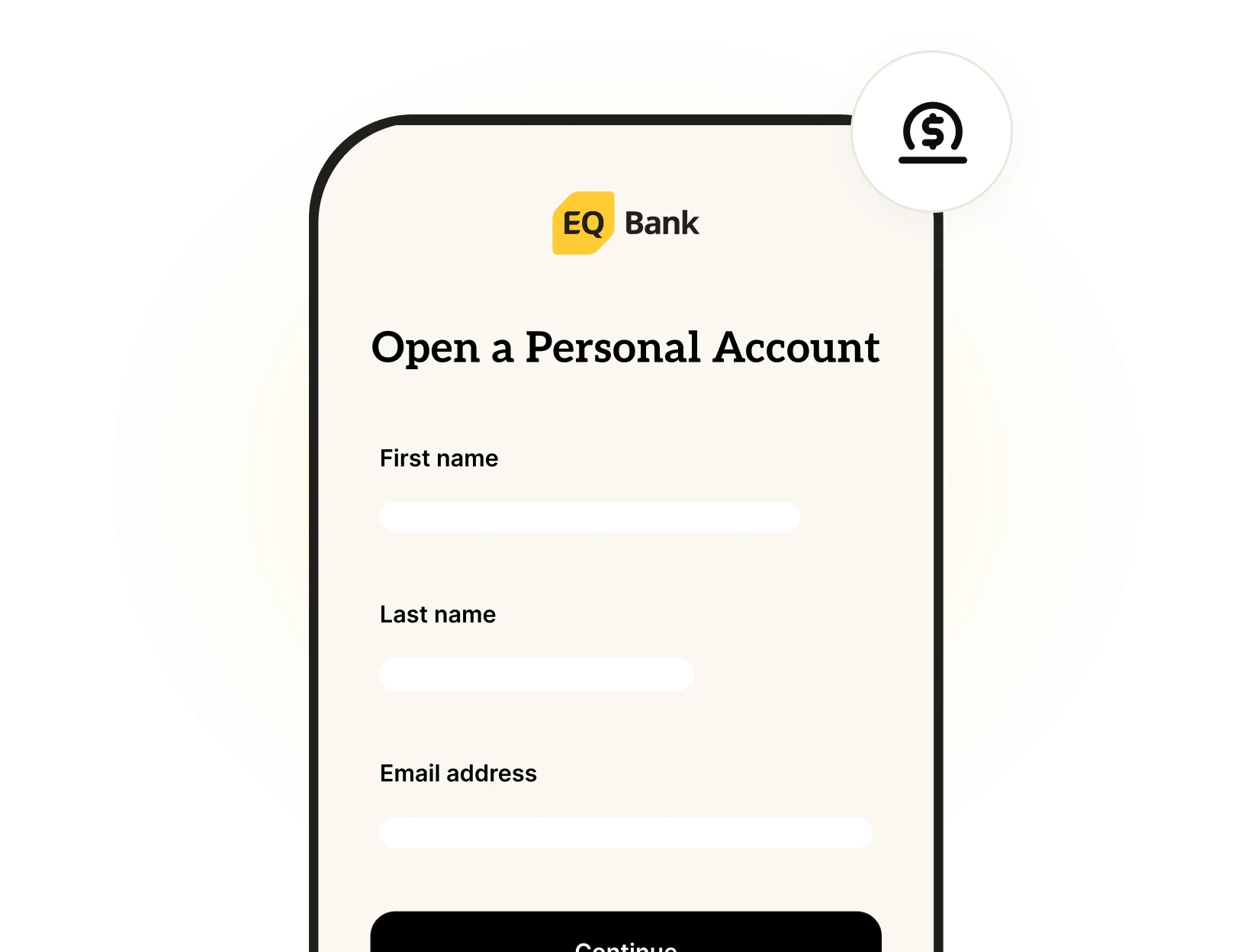

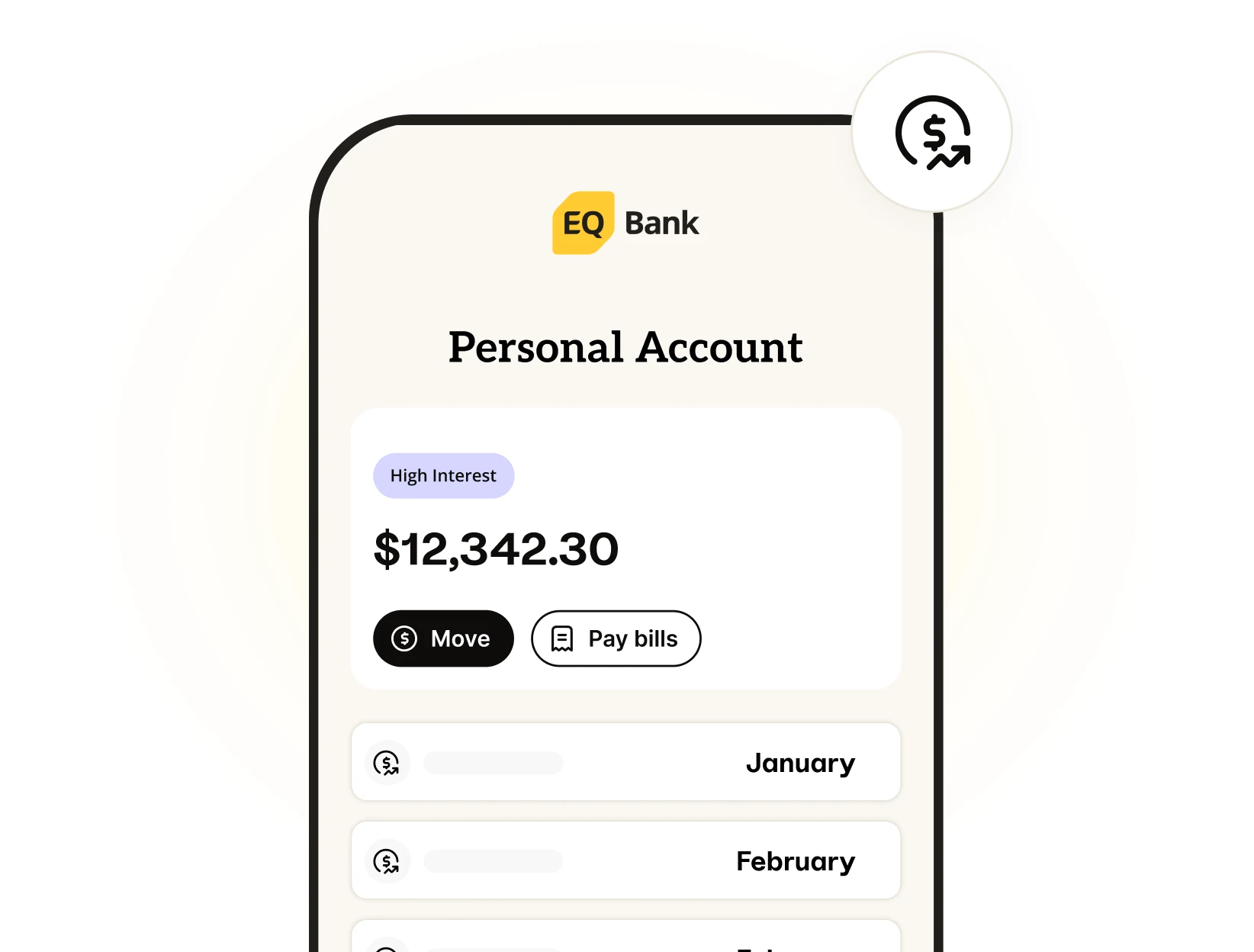

Open and fund a Personal Account

-

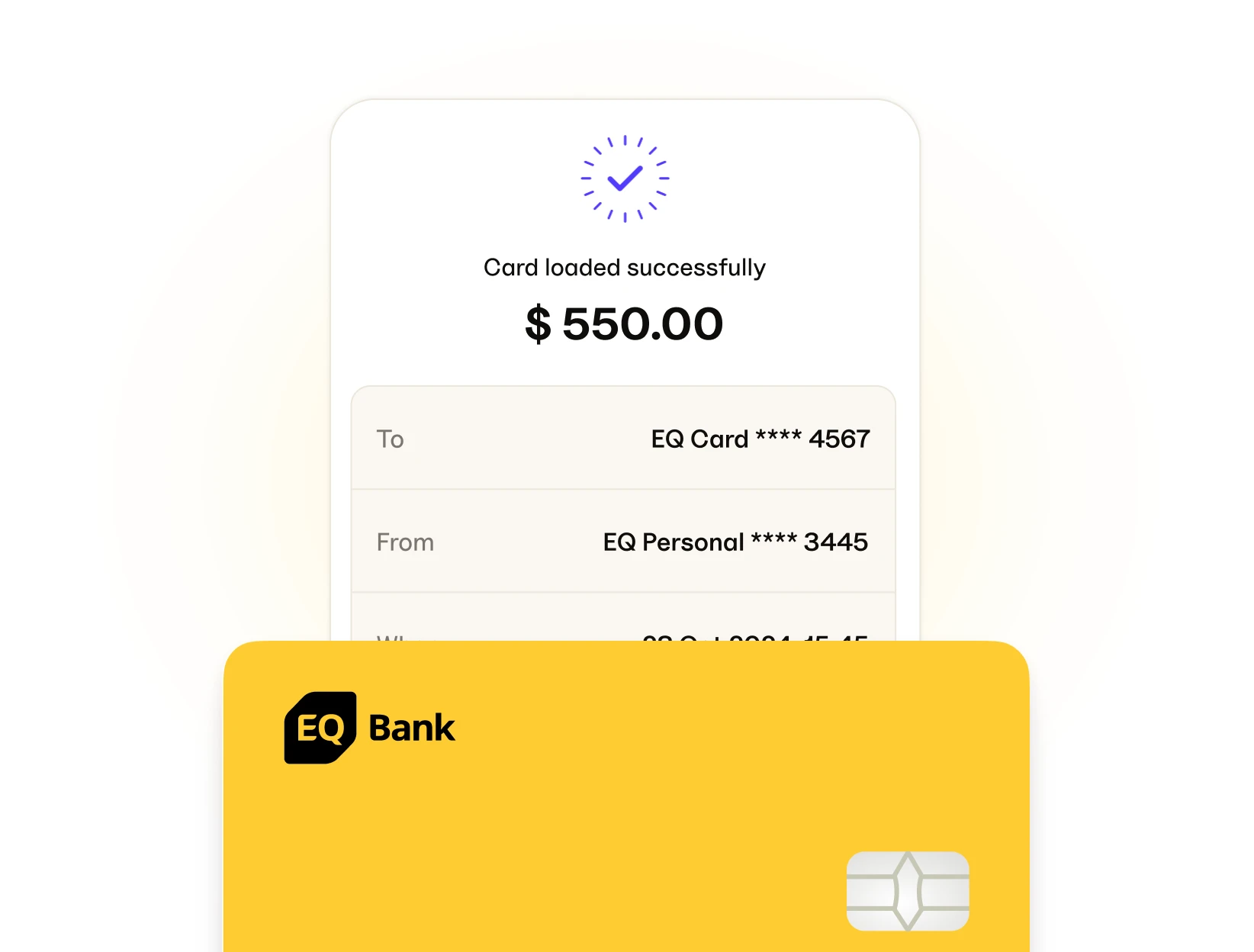

Add money to your card

-

Spend and get cash back

-

Earn on every dollar

Are you ready for a card that earns more without hidden fees? Open a Personal Account in minutes to get started.

Get your free cardNeed more info about the Personal Account? Learn more about our Personal Account

Is the EQ Bank Card right for you?

It’s right for you if:

- You want to earn cash back on your purchases.

- You want to use your mobile wallet to make purchases.

- You want a prepaid reloadable card you can use for online purchases.

- You want a prepaid reloadable card you can use internationally.

- You want no monthly fees, including free withdrawals from any ATM in Canada and no FX fees1.

- You want to earn interest on your card balance.

- You’re looking for a card that will not incur interest charges and will not impact your credit score.

- You're looking for a completely digital banking experience.

It’s not right for you if:

- You require the ability to pay with a traditional debit card.

- You need to deposit cash.

Have more questions? Visit our full FAQ.

Ask questions

Ask questions

Ask our friendly Chatbot anything or connect with a Customer Care Specialist.