.webp?sfvrsn=939484d0_9)

For those in business to make bank.

Not available in Quebec.

Apply for a Business AccountBy providing any personal information, you agree to the terms of our Privacy Agreement.

Business banking that hustles as hard as you do

Everything you need to manage your business finances. Spend, grow, and save with a range of easy-to-use-tools and zero monthly fees.

Business Account

$0 per month

Boost your bottom line with no monthly fees, free transactions,(Footnote 1) and 2.25% interest.(Footnote *)

Business GICs

Up to 3.75%(Footnote 2)

Grow your business with low-risk GICs at some of the best rates in the market.

Business Card

Coming soon

Meet the business card with no annual fees and cash back on monthly spending over $10k.(Footnote **)

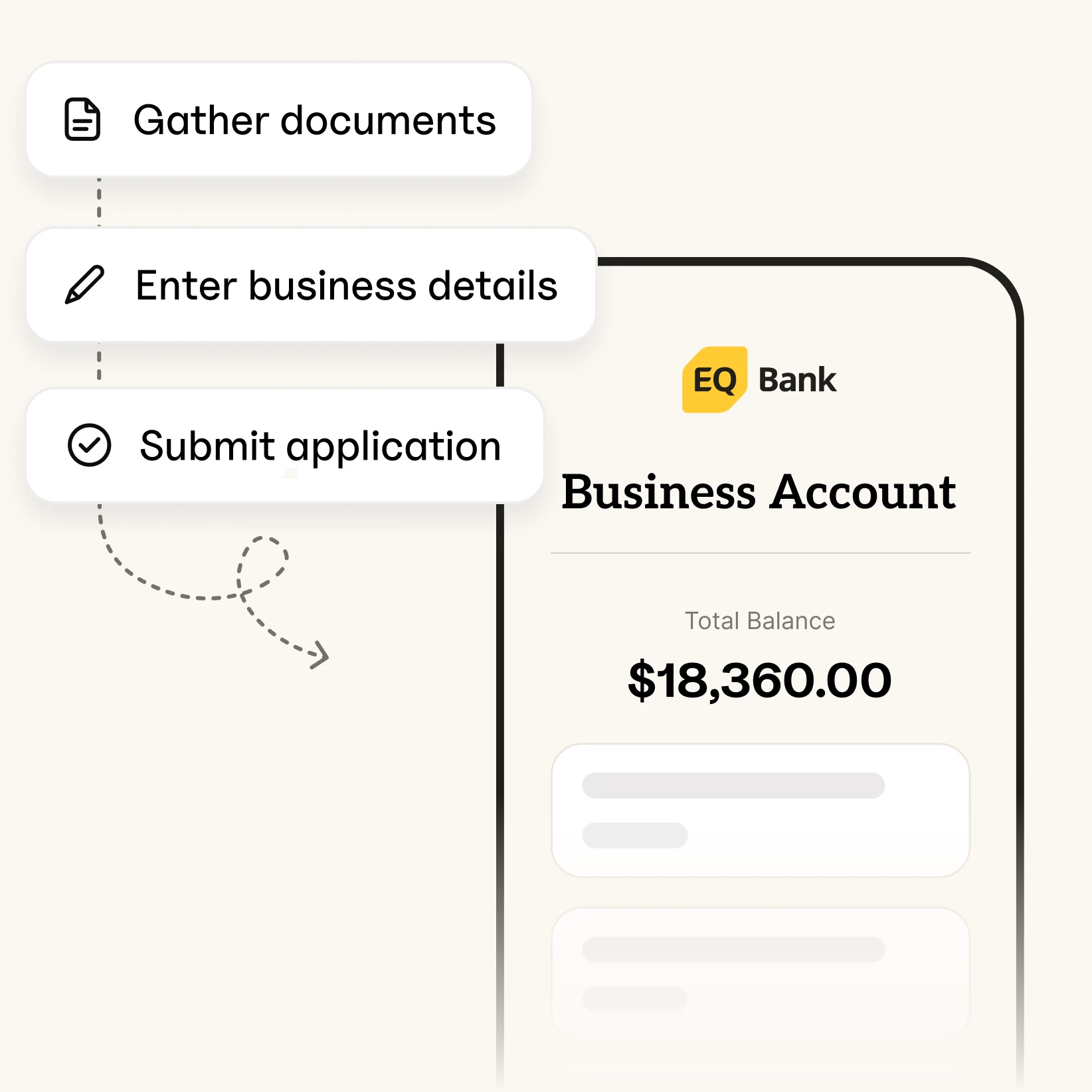

Skip the branch, apply online for free.

Stop paying monthly fees and start earning interest—apply for your Business Account online in minutes.

View checklist for documents required

Apply for a Business Account

Your business deserves the best in banking

Rated one of Forbes’ best banks in Canada

500k+ Canadians already bank with us

Dedicated customer support 7 days a week

Deposits may be eligible for CDIC protection†

Business banking you can bank on

| Other banks3 | EQ Bank Business Account | |

|---|---|---|

| Everyday banking fees | Up to $20 per month, may require a minimum balance to waive. | $0 per month, no minimum balance. |

| Interest rates | 0% | 2.25%* |

Send Interac e-Transfer (Footnote ®) | Up to 20 free | 50 free |

| Sign-up | Typically in-branch or via telephone. | Quick online application. |