The right rate and account for you? It’s right here.

Browse all our rates, compare different accounts, and find what works for you and your money goals.

Our rates Effective January 16, 2026.

Everyday Banking

| EQ Bank Product | Rate | |

|---|---|---|

Personal Account | Base rate: 1.00%* Bonus interest rate: 2.75%** (1.00%* base rate + 1.75%** bonus interest) | Learn more about our Personal Account |

Joint Account | Base rate: 1.00%* Bonus interest rate: 2.75%** (1.00%* base rate + 1.75%** bonus interest) | Learn more about our Joint Account |

Savings

| EQ Bank Product | Rate | |

|---|---|---|

10 Day Notice Savings Account | 2.35%* | Learn more about our Notice Savings Account |

30 Day Notice Savings Account | 2.75%* | Learn more about our Notice Savings Account |

TFSA Cash Savings Account | 1.50%* | Learn more about our TFSA Savings Account |

FHSA Cash Savings Account | 1.50%* | Learn more about our FHSA Savings Account |

RRSP Cash Savings Account | 1.50%* | Learn more about our RSP Savings Account |

US Dollar Account | 2.50%* | Learn more about our US Dollar Account |

Investments

GICs

Featured Rates

| EQ Bank Product | Rate | |

|---|---|---|

Non-registered 1 Year | 3.00%1 | Learn more about our about our GICs |

Registered 3 months | 2.60%1 | Learn more about our about our GICs |

Most popular GIC terms (1 to 5 years)

Non-registered

Registered GICs

TFSA

RRSP

FHSA

| Term | Rate* | Start investing |

|---|---|---|

| 1 Year | 3.00% | Get Rate |

| 15 Month | 3.00% | Get Rate |

| 2 Year | 3.25% | Get Rate |

| 27 Month | 3.25% | Get Rate |

| 3 Year | 3.60% | Get Rate |

| 4 Year | 3.65% | Get Rate |

| 5 Year | 3.75% | Get Rate |

| Term | Rate* | Start investing |

|---|---|---|

| 1 Year | 3.00% | Get Rate |

| 15 Month | 3.00% | Get Rate |

| 2 Year | 3.25% | Get Rate |

| 27 Month | 3.25% | Get Rate |

| 3 Year | 3.60% | Get Rate |

| 4 Year | 3.65% | Get Rate |

| 5 Year | 3.75% | Get Rate |

| Term | Rate* | Start investing |

|---|---|---|

| 1 Year | 3.00% | Get Rate |

| 15 Month | 3.00% | Get Rate |

| 2 Year | 3.25% | Get Rate |

| 27 Month | 3.25% | Get Rate |

| 3 Year | 3.60% | Get Rate |

| 4 Year | 3.65% | Get Rate |

| 5 Year | 3.75% | Get Rate |

| Term | Rate* | Start investing |

|---|---|---|

| 1 Year | 3.00% | Get Rate |

| 15 Month | 3.00% | Get Rate |

| 2 Year | 3.25% | Get Rate |

| 27 Month | 3.25% | Get Rate |

| 3 Year | 3.60% | Get Rate |

| 4 Year | 3.65% | Get Rate |

| 5 Year | 3.75% | Get Rate |

Short term GICs (less than 1 year)

Non-registered

Registered GICs

TFSA

RRSP

FHSA

| Term | Rate* | Start investing |

|---|---|---|

| 3 month | 2.60% | Get Rate |

| 6 month | 2.75% | Get Rate |

| 9 month | 2.85% | Get Rate |

| Term | Rate* | Start investing |

|---|---|---|

| 3 month | 2.60% | Get Rate |

| 6 month | 2.75% | Get Rate |

| 9 month | 2.85% | Get Rate |

| Term | Rate* | Start investing |

|---|---|---|

| 3 month | 2.60% | Get Rate |

| 6 month | 2.75% | Get Rate |

| 9 month | 2.85% | Get Rate |

| Term | Rate* | Start investing |

|---|---|---|

| 3 month | 2.60% | Get Rate |

| 6 month | 2.75% | Get Rate |

| 9 month | 2.85% | Get Rate |

Long term GICs (1 year or more)

Non-registered GICs

Registered GICs

TFSA

RRSP

FHSA

| Term | Rate* | Start investing |

|---|---|---|

| 1 Year | 3.00% | Get Rate |

| 15 Month | 3.00% | Get Rate |

| 2 Year | 3.25% | Get Rate |

| 27 Month | 3.25% | Get Rate |

| 3 Year | 3.60% | Get Rate |

| 4 Year | 3.65% | Get Rate |

| 5 Year | 3.75% | Get Rate |

| 6 Year | 2.35% | Get Rate |

| 7 Year | 2.35% | Get Rate |

| 10 Year | 2.35% | Get Rate |

| Term | Rate* | Start investing |

|---|---|---|

| 1 Year | 3.00% | Get Rate |

| 15 Month | 3.00% | Get Rate |

| 2 Year | 3.25% | Get Rate |

| 27 Month | 3.25% | Get Rate |

| 3 Year | 3.60% | Get Rate |

| 4 Year | 3.65% | Get Rate |

| 5 Year | 3.75% | Get Rate |

| 6 Year | 2.35% | Get Rate |

| 7 Year | 2.35% | Get Rate |

| 10 Year | 2.35% | Get Rate |

| Term | Rate* | Start investing |

|---|---|---|

| 1 Year | 3.00% | Get Rate |

| 15 Month | 3.00% | Get Rate |

| 2 Year | 3.25% | Get Rate |

| 27 Month | 3.25% | Get Rate |

| 3 Year | 3.60% | Get Rate |

| 4 Year | 3.65% | Get Rate |

| 5 Year | 3.75% | Get Rate |

| 6 Year | 2.35% | Get Rate |

| 7 Year | 2.35% | Get Rate |

| 10 Year | 2.35% | Get Rate |

| Term | Rate* | Start investing |

|---|---|---|

| 1 Year | 3.00% | Get Rate |

| 15 Month | 3.00% | Get Rate |

| 2 Year | 3.25% | Get Rate |

| 27 Month | 3.25% | Get Rate |

| 3 Year | 3.60% | Get Rate |

| 4 Year | 3.65% | Get Rate |

| 5 Year | 3.75% | Get Rate |

| 6 Year | 2.35% | Get Rate |

| 7 Year | 2.35% | Get Rate |

| 10 Year | 2.35% | Get Rate |

Compare accounts and features

| Personal (& Joint) Account The best features of a chequing account with high interest and no fees

on everyday banking. | Notice Savings Account Some of the best savings rates in Canada and access to your money with

as little as 10 days notice. | US Dollar Account A registered account that helps you save for goals big or small, with

tax-free interest earnings. | |

|---|---|---|---|

| Interest rate | 2.75% (Footnote **) when you direct deposit your pay (1.00%(Footnote *) otherwise) | 2.75%

(Footnote *)

with 30-day notice 2.35%(Footnote *) with 10-day notice | 2.50%(Footnote *) |

| Monthly fees | $0 | $0 | $0 |

| Access to funds | Yes, withdraw at any time. | Yes, request to withdraw at any time—subject to notice period. | Yes, withdraw at any time. |

| Send or receive Interac e-Transfers® | Yes, unlimited number of free Interac e-Transfers®. | No | No |

| Bill payments | Yes, unlimited number of free bill payments. | No | No |

| ATM access | Yes, with the free EQ Bank Card. | No | No |

| Currency | CAD | CAD | USD |

| International Money Transfers (via Wise) | Yes (CAD to other currencies). | No | Yes (USD to other currencies). |

|

Personal (& Joint) Account

The best features of a chequing account with high interest and no fees

on everyday banking. |

|

|---|---|

| Interest rate | 2.75% (Footnote **) when you direct deposit your pay (1.00%* otherwise) |

| Monthly fees | $0 |

| Access to funds | Yes, withdraw at any time. |

|

Send or receive Interac e-Transfers® |

Yes, unlimited number of free Interac e-Transfers®. |

| Bill payments | Yes, unlimited number of free bill payments. |

| ATM access | Yes, with the free EQ Bank Card. |

| Currency | CAD |

| International Money Transfers (via Wise) | Yes (CAD to other currencies). |

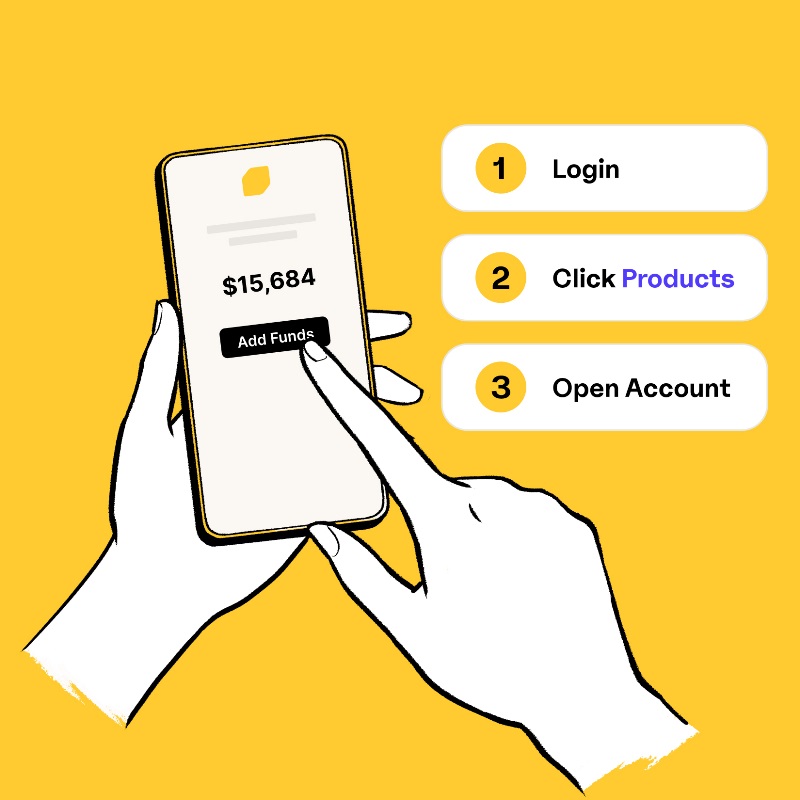

It all starts with a Personal Account

Get started|

Notice Savings Account

Some of the best savings rates in Canada and access to your money with

as little as 10 days notice. |

|

|---|---|

| Interest rate |

2.75%

(Footnote *)

with 30-day notice 2.35%(Footnote *) with 10-day notice |

| Monthly fees | $0 |

| Access to funds | Yes, request to withdraw at any time—subject to notice period. |

|

Send or receive Interac e-Transfers® |

No |

| Bill payments | No |

| ATM access | No |

| Currency | CAD |

| International Money Transfers (via Wise) | No |

It all starts with a Personal Account

Get started|

US Dollar Account

A registered account that helps you save for goals big or small, with

tax-free interest earnings. |

|

|---|---|

| Interest rate | 2.50%(Footnote *) |

| Monthly fees | $0 |

| Access to funds | Yes, withdraw at any time. |

|

Send or receive Interac e-Transfers® |

No |

| Bill payments | No |

| ATM access | No |

| Currency | USD |

| International Money Transfers (via Wise) | Yes (USD to other currencies). |

It all starts with a Personal Account

Get startedCompare investment accounts

| FHSA A tax-advantaged registered plan designed to help you save for your first home.(Footnote 2) | RRSP A registered investment account that helps you save for retirement and reduce taxable income now. | TFSA A registered account that helps you save for goals big or small, with tax-free interest earnings. | |

|---|---|---|---|

| Interest rate | 1.50% (Footnote *) | 1.50% (Footnote *) | 1.50% (Footnote *) |

| Contribution limits | $8,000 annual, $40,000 lifetime. | 18% of previous year's income or $32,490 (2025), whichever is lower. No lifetime limit. | $7,000 annual. No lifetime limit. |

| Eligibility | Canadian residents aged 18-71, first-time home buyers.(Footnote 3) | Canadian residents under 71 with earned income. | Canadian residents aged 18+. |

| Tax benefit | Contributions are tax-deductible. | Contributions are tax-deductible. | Contributions are not tax-deductible, but withdrawals are tax-free. |

| Withdrawals | Tax-free if used for a qualifying home purchase.(Footnote 2) Non-qualifying withdrawals are taxable. | Withdrawals are considered taxable income. | Withdrawals are tax-free. |

|

FHSA A tax-advantaged registered plan designed to help you save for your first home.(Footnote 2) |

|

|---|---|

| Interest rate | 1.50% (Footnote *) |

| Contribution limits | $8,000 annual, $40,000 lifetime. |

| Eligibility | Canadian residents aged 18-71, first-time home buyers.(Footnote 3) |

| Tax benefit | Contributions are tax-deductible. |

| Withdrawals | Tax-free if used for a qualifying home purchase.(Footnote 2) Non-qualifying withdrawals are taxable. |

It all starts with a Personal Account

Get started| RRSP A registered investment account that helps you save for retirement and reduce taxable income now. | |

|---|---|

| Interest rate | 1.50% (Footnote *) |

| Contribution limits | 18% of previous year's income or $32,490 (2025), whichever is lower. No lifetime limit. |

| Eligibility | Canadian residents under 71 with earned income. |

| Tax benefit | Contributions are tax-deductible. |

| Withdrawals | Withdrawals are considered taxable income. |

It all starts with a Personal Account

Get started|

TFSA A registered account that helps you save for goals big or small, with tax-free interest earnings. |

|

|---|---|

| Interest rate | 1.50% (Footnote *) |

| Contribution limits | $7,000 annual. No lifetime limit. |

| Eligibility | Canadian residents aged 18+. |

| Tax benefit | Contributions are not tax-deductible, but withdrawals are tax-free. |

| Withdrawals | Withdrawals are tax-free. |

It all starts with a Personal Account

Get startedBanking you can count on

Ready to take advantage of our great rates?

Sign up online in minutes and start earning more—for the short term, long term, and even for the everyday.

Get started by opening a Personal Account

Already an EQ Bank customer? Sign in