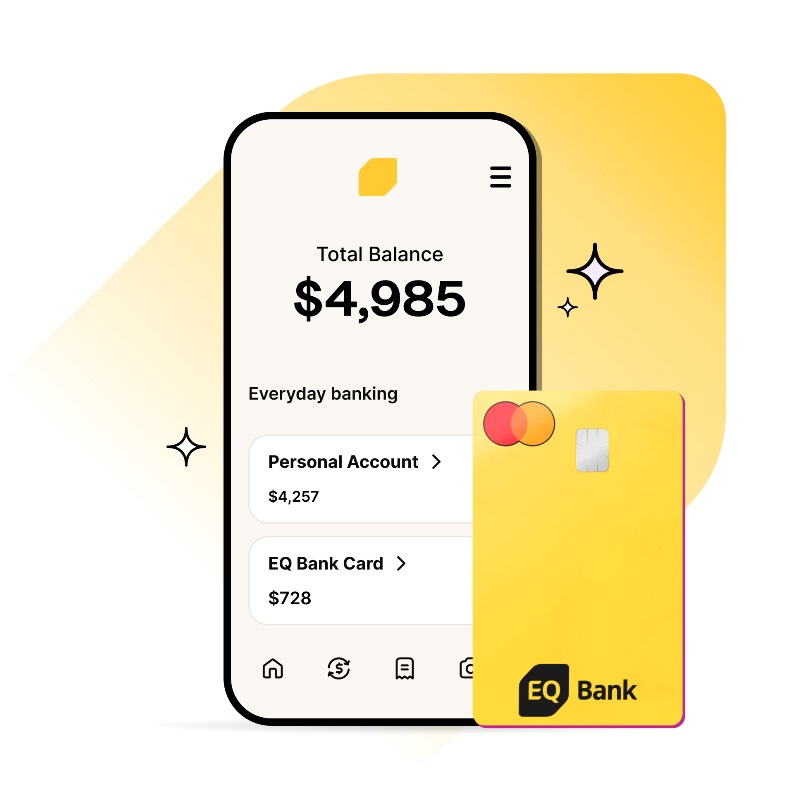

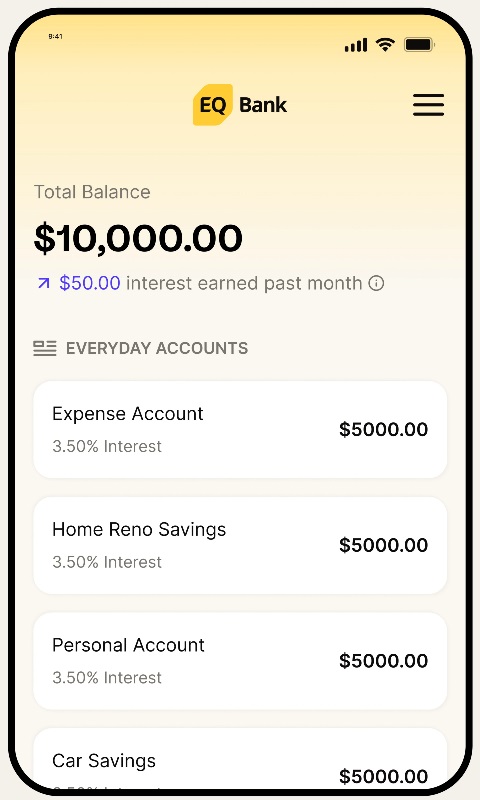

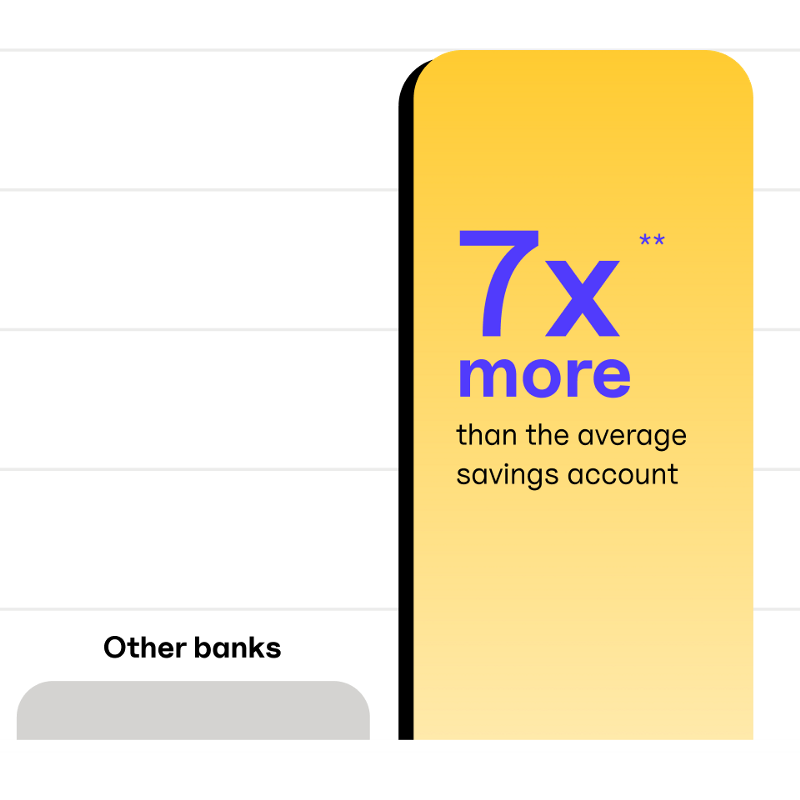

Acts like chequing, earns like savings

Enjoy the day-to-day flexibility of a chequing account, with an interest rate up to 7x higher** than the average savings account when you direct deposit your pay*.

Join now Learn more

Meet the card stacked in your favour

With the EQ Bank Card3 in your wallet, you get free withdrawals from any ATM in Canada, zero FX fees2 when spending abroad, and cash back2 on every purchase.

Learn more about the EQ Bank Card.

Make your money work for you—without the work.

Looking for more Personal Account info? Everything you need to know.

Security you can trust

With CDIC deposit insurance eligibility† and multiple layers of security and fraud monitoring, we take protecting your privacy and financial information seriously.

Is the Personal Account right for you?

It’s right for you if:

- You’re looking for an account with no everyday banking fees and an unlimited number of transactions each month.

- You’re looking to make everyday banking transactions, such as direct deposits, pre-authorized debits, Interac e-Transfers®, and bill payments.

- You’re looking to earn high interest on your day-to-day banking.

- You need instant access to your funds.

- You’re looking for an account that’s eligible for CDIC protection.

- You're looking for a completely digital banking experience.

It’s not right for you if:

- You’re looking for an account that offers cheques.

- You’re looking for an account that offers bank drafts and in-branch support.

- You need to deposit cash.

Visit our FAQ for more details about our Personal Account.