GICs High growth. Guaranteed returns. Lock in 5.35%* on a 1-year GIC.

Get guaranteed returns on registered and non-registered GICs with some of the best rates in the market.

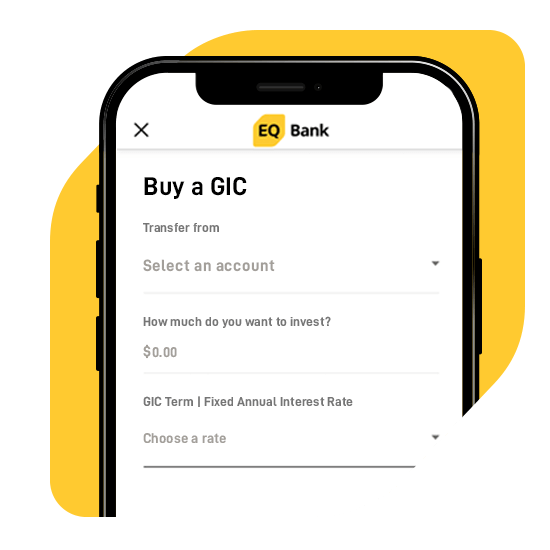

Get started

Don’t miss our featured GIC rates

Get a GIC rate that’s yours to keep

Have questions? Get answers to common questions about GICs here.

Most popular GIC terms (1 to 5 years)

Non-registered

Registered GICs

TFSA

RSP

FHSA

| Term | Rate* | Start investing |

|---|---|---|

| 1 Year | 5.35% | Get Rate |

| 15 Month | 5.20% | Get Rate |

| 2 Year | 5.00% | Get Rate |

| 27 Month | 4.95% | Get Rate |

| 3 Year | 4.80% | Get Rate |

| 4 Year | 4.55% | Get Rate |

| 5 Year | 4.45% | Get Rate |

| Term | Rate* | Start investing |

|---|---|---|

| 1 Year | 5.35% | Get Rate |

| 15 Month | 5.20% | Get Rate |

| 2 Year | 5.00% | Get Rate |

| 27 Month | 4.95% | Get Rate |

| 3 Year | 4.80% | Get Rate |

| 4 Year | 4.55% | Get Rate |

| 5 Year | 4.45% | Get Rate |

| Term | Rate* | Start investing |

|---|---|---|

| 1 Year | 5.35% | Get Rate |

| 15 Month | 5.20% | Get Rate |

| 2 Year | 5.00% | Get Rate |

| 27 Month | 4.95% | Get Rate |

| 3 Year | 4.80% | Get Rate |

| 4 Year | 4.55% | Get Rate |

| 5 Year | 4.45% | Get Rate |

| Term | Rate* | Start investing |

|---|---|---|

| 1 Year | 5.35% | Get Rate |

| 15 Month | 5.20% | Get Rate |

| 2 Year | 5.00% | Get Rate |

| 27 Month | 4.95% | Get Rate |

| 3 Year | 4.80% | Get Rate |

| 4 Year | 4.55% | Get Rate |

| 5 Year | 4.45% | Get Rate |

Short term GICs (less than 1 year)

Non-registered

Registered GICs

TFSA

RSP

FHSA

| Term | Rate* | Start investing |

|---|---|---|

| 3 month | 4.00% | Get Rate |

| 6 month | 4.75% | Get Rate |

| 9 month | 5.00% | Get Rate |

| Term | Rate* | Start investing |

|---|---|---|

| 3 month | 4.00% | Get Rate |

| 6 month | 4.75% | Get Rate |

| 9 month | 5.00% | Get Rate |

| Term | Rate* | Start investing |

|---|---|---|

| 3 month | 4.00% | Get Rate |

| 6 month | 4.75% | Get Rate |

| 9 month | 5.00% | Get Rate |

| Term | Rate* | Start investing |

|---|---|---|

| 3 month | 3.75% | Get Rate |

| 6 month | 4.50% | Get Rate |

| 9 month | 4.75% | Get Rate |

Long term GICs (1 year or more)

Non-registered GICs

Registered GICs

TFSA

RSP

FHSA

| Term | Rate* | Start investing |

|---|---|---|

| 1 Year | 5.35% | Get Rate |

| 15 Month | 5.20% | Get Rate |

| 2 Year | 5.00% | Get Rate |

| 27 Month | 4.95% | Get Rate |

| 3 Year | 4.80% | Get Rate |

| 4 Year | 4.55% | Get Rate |

| 5 Year | 4.45% | Get Rate |

| 6 Year | 3.80% | Get Rate |

| 7 Year | 3.80% | Get Rate |

| 10 Year | 3.80% | Get Rate |

| Term | Rate* | Start investing |

|---|---|---|

| 1 Year | 5.35% | Get Rate |

| 15 Month | 5.20% | Get Rate |

| 2 Year | 5.00% | Get Rate |

| 27 Month | 4.95% | Get Rate |

| 3 Year | 4.80% | Get Rate |

| 4 Year | 4.55% | Get Rate |

| 5 Year | 4.45% | Get Rate |

| 6 Year | 3.80% | Get Rate |

| 7 Year | 3.80% | Get Rate |

| 10 Year | 3.80% | Get Rate |

| Term | Rate* | Start investing |

|---|---|---|

| 1 Year | 5.35% | Get Rate |

| 15 Month | 5.20% | Get Rate |

| 2 Year | 5.00% | Get Rate |

| 27 Month | 4.95% | Get Rate |

| 3 Year | 4.80% | Get Rate |

| 4 Year | 4.55% | Get Rate |

| 5 Year | 4.45% | Get Rate |

| 6 Year | 3.80% | Get Rate |

| 7 Year | 3.80% | Get Rate |

| 10 Year | 3.80% | Get Rate |

| Term | Rate* | Start investing |

|---|---|---|

| 1 Year | 5.35% | Get Rate |

| 15 Month | 5.20% | Get Rate |

| 2 Year | 5.00% | Get Rate |

| 27 Month | 4.95% | Get Rate |

| 3 Year | 4.80% | Get Rate |

| 4 Year | 4.55% | Get Rate |

| 5 Year | 4.45% | Get Rate |

| 6 Year | 3.80% | Get Rate |

| 7 Year | 3.80% | Get Rate |

| 10 Year | 3.80% | Get Rate |

Smart features

How much growth are we really talking about?

Use our calculator to see how much your savings will grow with our different options.

Interest calculations are estimates.

Common questions answered

Visit our FAQ for more details about our GICs.

Looking to learn more about GICs?

Get smarter about investing with the help of our handy articles.